LET US HELP YOU

We want to make understanding your investments a simple, straightforward process. Here are some resources that explain the key concepts you should know.

DIFFERENCE BETWEEN A FUND AND A MODEL

Both managed funds and portfolio models are managed by professional investment managers; however they have some clear differences.

Fund

- Professional investment management

- Access to sophisticated investments

- Suited to investment approaches with significant diversification

- Customisable

- Beneficial ownership of securities

- Personal tax positions

Model

- Professional investment management

- Customisable

- Beneficial ownership of securities

- Personal tax positions

- Can hold a mix of shares, ETFs and managed funds

HOW TO READ A PROFILE

Fund

A fund profile contains 4 key pieces of information. These are designed to clearly communicate the purpose of the fund along with it ongoing performance.

Review objective

The objective is a brief description of what this particular investment fund is attempting to achieve.

Performance Chart

The performance chart shows the value of $1 invested from the time this investment fund was offered.

Asset allocation

Asset allocation provides a snapshot of the various types of investments categories investors are exposure to through the fund.

Performance Table

The performance table shows the percentage return for various periods to a point in time. Investors should be aware that large positive or negative returns over short periods can distort performance reported over the longer term

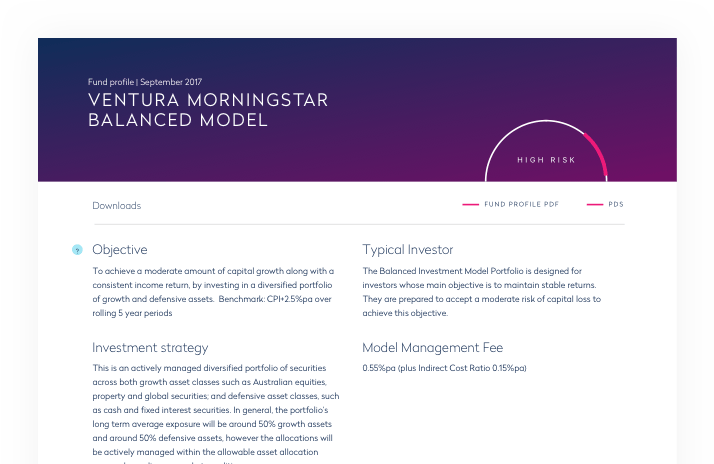

Model

A model profile contains 4 key pieces of information designed to clearly communicate the purpose and ongoing performance of the model.

Review objective

The objective is a brief description of what this particular investment model is attempting to achieve.

Performance Chart

The performance chart shows the value of $1 invested from the time this investment model was offered.

Asset Allocation

Asset allocation provides a snapshot of the various types of investments categories investors are exposure to through the model.

Performance Table

The performance table shows the percentage return for various periods to a point in time. Investors should be aware that large positive or negative returns over short periods can distort performance reported over the longer term

Let us show you

TAKE ME THROUGH A PROFILEGET IN TOUCH

If you're ready to find out more about this or Ventura's offering then don't hesitate to get in touch.

CONTACT VENTURA